During 2020 and 2021, CIfA has undertaken several surveys of members to gather evidence of the impact of the pandemic, and wider issues on the sector and the workforce. This evidence has helped us to inform Government, working directly with the Department for Digital Culture Media and Sport, Historic England, Cadw, and Historic Environment Scotland, as well as with wider groups of sector bodies throughout the Pandemic.

As well as Covid impacts, the data shows that wider skills issues amid soaring demand for archaeologists, recruitment challenges, and additional pressures of Brexit cannot be easily separated from current challenges.

While most businesses have remained resilient against these challenges, responses to our survey highlight that this is in large part due to the staff at all levels of the sector, working incredibly hard through challenging working conditions. Responses highlighted the impact that this has had on the health and wellbeing of the workforce and we question the long-term impact this could potentially have on our sector.

This bulletin seeks to highlight some of the outcomes of the most recent survey, conducted in October 2021, and sets out how CIfA will be addressing some of these issues in 2022.

Note on the survey:

- The latest survey was conducted in October and therefore does not reflect current understandings of the likely impact of the Omicron variant. CIfA is interested to hear any evidence relating to impacts at this time and into the New Year, particularly related to the extent of staff absences due to infections or other related issues as omicron spreads. If you have evidence, please use this link to submit.

- This report focuses on the majority view evident through survey responses and provides stats to illustrate the strength of that majority. There were, however, minority views expressed in virtually all cases, ranging from different experiences of the impact of the pandemic, different expectations for the future, and different perceptions views on the nature of the pandemic, Brexit, and wider politics.

- Where survey respondents have been quoted, responses may have been edited for spelling and grammar, but are otherwise provided in their original words.

The ongoing Pandemic:

- It is with a heavy heart that the profession heads into a second Festive break with significant impacts from the Covid-19 Pandemic. The Omicron variant’s spread is likely to force a return to more stringent restrictions.

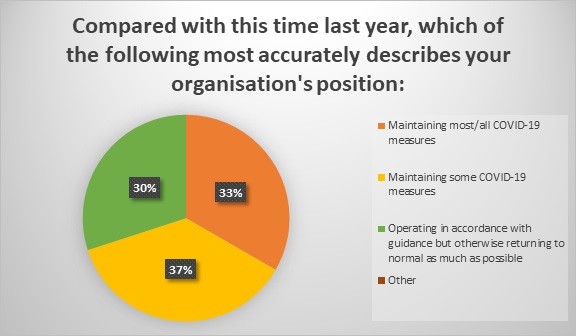

- The profession should be relatively well prepared for this, with most organisations having retained most or all of the same safety measures as in the 2020 height of the initial waves. The Social Distancing for Archaeology Toolkit contains plenty of useful advice.

- Most employers, soles traders, and employees are operating despite additional pressures, and still support safety measures, and planned to keep them.

- Responses acknowledge that the largest burden has fallen on site staff, who have endured the greatest upheaval and shouldered the greatest risk. This is borne out by survey responses highlighting Covid absence rates and other impacts, compared with home-workers who, despite overcoming various logistical challenges, report generally positive experiences of working arrangements.

- Comments referencing mental health impacts highlighted a particularly detrimental effect across all workers:

“Masks, social distancing, additional welfare on site, travel arrangements, etc have decreased our efficiency, upped our costs and environmental impact, but above all the subtle erosion of social interactions and distancing. This has had a corrosive effect on the mental health of some of our team with effects ranging from slight through to severe as the isolation and other secondary effects of Covid really bite. This has had a substantial impact on our organisation and has put even more pressure on those coping as they are having to carry through others. This has put the whole organisation under a lot of pressure and we are firefighting to keep the mental health impact in check and support our team.”

(Archaeological employer)

“We are experiencing a lot of metal health issues with staff and are having to be more flexible in terms of the type of work we ask people to do”

(Archaeological employer)

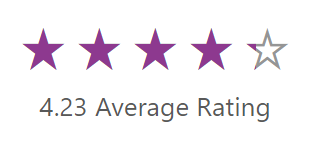

- The gratifying highlight of the data is that employees are mostly extremely positive about how well their organisations’ have responded to the pandemic:

- One employee wrote:

“The pandemic was traumatic for everyone, and workplaces such as ours, where staff were classed as key-workers, had to work together to create a culture of safety and efficiency. Our company did that very well, we were very efficient and took all the things the pandemic threw at us in our stride.”

- CIfA is keen to hear any updated reflections from companies preparing for impacts of COVID-19 or evidence of staff absences in recent weeks and into the New Year. Please submit any comments here. Or email admin@archaeologists.net.

Business impacts:

- A common theme in responses to questions about business impacts relates to the cumulative pressures of Covid restrictions, workforce changes caused by Brexit and exacerbated by Covid, and wider, longer term recruitment and retention issues.

- One employer said:

“It has been a challenging time for Archaeology. We have experienced labour shortage, which we don't think is going away, which has resulted in skills shortages in some areas. Supply chain has presented some very slight challenges - not so much because of lack of stock but delays in getting equipment and materials to site/people due to driver shortages. We are still experiencing exceptionally high demand.”

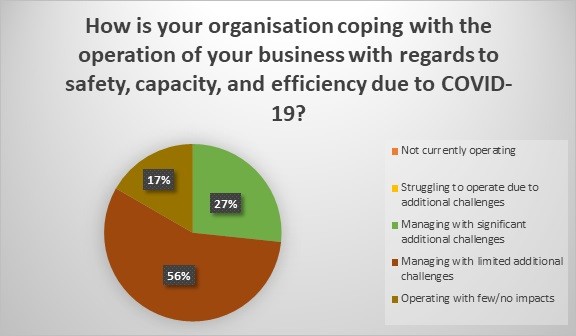

- Happily, most employers are continuing to operate, with manageable impact from Covid, with the majority suggesting that they are ‘managing with limited additional ongoing challenges’ and zero responses ‘struggling to operate’ or ‘not operating due’ to additional challenges’:

- However, these statistics are likely to mask a variable picture. For instance, some sole traders reported serious impacts, either relating to workflow for specialist services which have been impacted, or due to having less flexibility to manage impacts.

- One sole trader said:

“I have seen a slight decrease in demand over the period of covid and had to take a lot of time off work for childcare due to school closures, isolating due to being a close contact and contracting covid.”

- Where larger companies are managing impacts, this also has the potential to cause downstream impacts. One sub-contractor commented:

“Demand for [Registered Organisation] is still there but the appeal for the [major project] has caused problems for the company as it has led to their main project being halted hence why they currently can't employ me.”

- When asked about impacts in the 3 months to October 2021, the most frequently reported impacts among self-employed archaeologists were;

- “I have taken a pay cut/earned less than expected”, and

- “I have lost contracts”

- Compared with their employers, employees were slightly more likely to suggest Covid was having a more serious detrimental impact on their work:

- 5% cited a major detrimental impact

- 17% a moderate detrimental impact

- 48% a slight detrimental impact

- 30% no detrimental impact

Demand

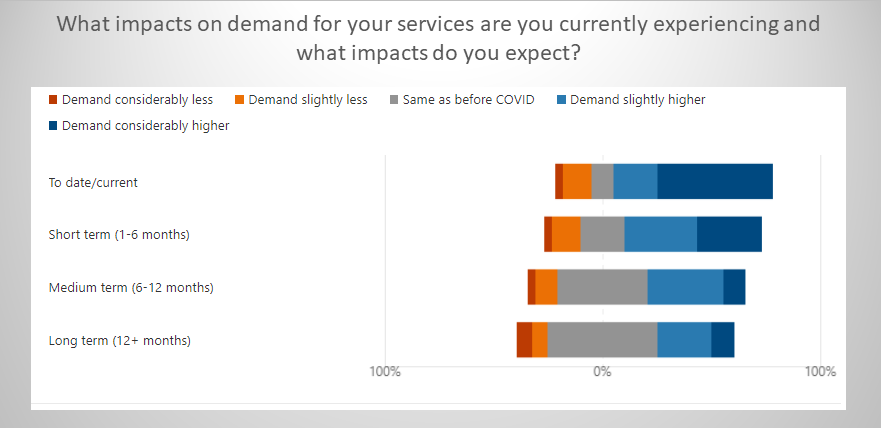

- Employers generally report demand ‘considerably higher’ than usual over the year to October. While confidence about this trend continuing over the year ahead was not strong, a majority expected demand to remain at least ‘slightly higher’ than usual over the next 6 months, with still over 40% expecting this demand to remain up to and beyond a year ahead.

- Echoing a common tone, one employer said:

“We are anticipating a sustained surge in the development sector resulting in excess demand relative to market capacity. However, we do not expect there to be sufficient labour supply to enable company growth.”

- A sole trader specialising in geophysics added:

“We are essentially booked up for the rest of the year and are taking bookings into the new year. We’ve never had that amount of bookings that far out.”

- However, another employer acknowledged:

“Predicting future trends is notoriously difficult and dependent on the development/construction sector - and perhaps changes to the planning system in the long term.”

- A further employer voiced frustrations, shared by others, with the apparent inability of the sector to capitalise on a possible opportunity:

“The level of demand should be an opportunity for the heritage sector to actually charge a realistic fee for the work undertaken and compensate our staff in line with their qualifications and expertise, however I see the sector reverting to form and no progress being made.”

Skills shortages

- Underpinning sector unease about high demand is the consequent increase in the challenges of recruitment and training to ensure sufficient skills capacity. In this area, Covid, Brexit and wider training concerns appear intertwined.

- Employers wrote:

“We cannot hire at the skills level we would wish to due to the activity level in the market, hence our new hires are recent graduates; they're great individuals but the lack of practical experience and related skills which means we have to invest much more in terms of supporting their development.”

“We have skills gaps in specialist staff and experienced field archaeologists. I don't feel this is a short term problem.”

“Previously we would have had more applicants for skilled roles from the EU.”

“Temporary loss of site staff as they have to isolate, causing delays and jeopardising fieldwork,”

- The most commonly cited skills gaps were for site supervisors and project managers.

Conclusions

This bulletin summarises just a few of the insightful highlights from the survey data. What is clear is that past 12 months has seen unprecedented pressure applied to the sector to meet the demand for archaeological services – through the combined factors of Brexit, Covid, and threats to higher education. These factors have also served to highlight and exacerbate existing skills issues.

In 2022, CIfA is looking to stimulate conversation among other sector organisations which will seek to explore these factors and attempt to chart a sector wide, forward plan of action to mitigate against these pressures.

If you have reflections on this report or would like to provide further information, please contact admin@archaeologists.net. We will be sending another survey to capture updated perceptions at an appropriate point in early 2022.

In the meantime, if you have evidence about impacts of the Omicron variant surge please send your comments via this link.